Appendix 3.5: Ferdinand R. Marcos II v. Court of Appeals, The Commissioner of the Bureau of Internal Revenue and Herminia D. de Guzman

Abstract

This resolution upheld, with finality, the legality of the “action of the Commissioner of Internal Revenue of levying on real property of the estate of Ferdinand E. Marcos to recover the deficiency income tax assessments and estate tax assessment thereon,” which Bongbong Marcos questioned partly in his capacity as one of his father’s heirs. Bongbong’s mistake, as per the resolution, was going directly to the Court of Appeals (filing a petition for certiorari) instead of exhausting the proper remedies provided by the law. As some of the other appendices show, this focus on technicalities in formulating defenses is a Marcos hallmark, and while it has not worked all the time, it prevents the Marcoses from making statements on the facts of cases. In this case, by not stating his take on how much estate tax should be levied on the Marcos estate, he avoided having to give a precise valuation of the estate. Bongbong also apparently did not make any direct protest regarding the Commissioner of Internal Revenue’s assessment specifically of his deficiency income tax, which was valued “in the amounts of P258.70 pesos; P9,386.40 Pesos; P4,388.30 Pesos; and P6,376.60” for the years 1982–1985, or when he was vice governor/governor of Ilocos Norte (see G.R. 120880 [decision], promulgated on 5 June 1997). This is presumably the same cause of action for the criminal tax evasion case filed against Bongbong Marcos, which resulted in a nine-year sentence in July 1995 (Deseret News 1995). Marcos filed an appeal the same year (UPI 1995). It is difficult to determine what happened next based on publicly accessible sources; certainly, the sentence has not been carried out.

Published

2017-12-04

How to Cite

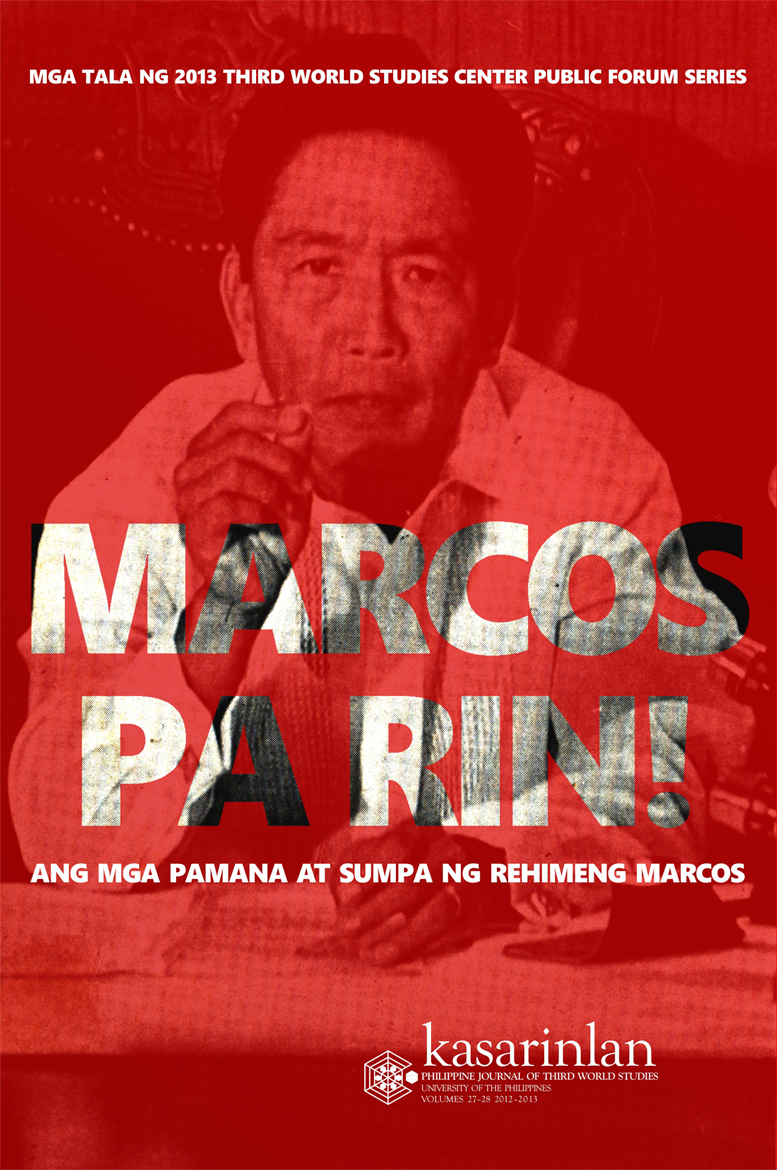

PHILIPPINE JOURNAL OF THIRD WORLD STUDIES, Kasarinlan.

Appendix 3.5: Ferdinand R. Marcos II v. Court of Appeals, The Commissioner of the Bureau of Internal Revenue and Herminia D. de Guzman.

Kasarinlan: Philippine Journal of Third World Studies, [S.l.], p. 449-452, dec. 2017.

ISSN 2012-080X.

Available at: <https://journals.upd.edu.ph/index.php/kasarinlan/article/view/5898>. Date accessed: 02 sep. 2025.

Section

Appendices

By submitting a manuscript, the authors agree that the exclusive rights to reproduce and distribute the article have been given to the Third World Studies Center.