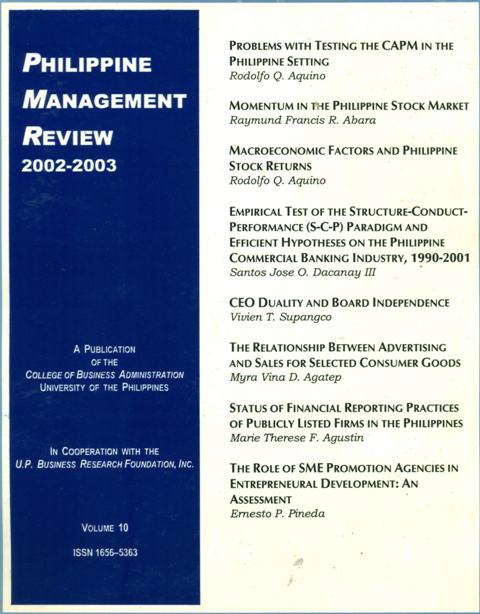

Macroeconomic Factors and Philippine Stock Returns

Abstract

This study focuses on the role of macroeconomic fluctuations as risk factors that influence cross-sectional variability in stock returns. The study covered the listed firms represented in the Phisix for the period 1994-2000. It uses a multifactor asset pricing framework that is based on the inherent trade-off between risk and return that has been a basic principle of investment theory since at least Markowitz. Seven macroeconomic factors, in addition to excess market return, are identified as potential source of significant risks to individual firms. Regression results indicate that fluctuations in all of these macroeconomic factors have significant influence on individual stock returns.

An exact formulation of the multifactor asset pricing model, however, fails to price the macroeconomic risk factors. Some possible explanations are offered for the poor results. The first one is that available macroeconomic data do not provide adequate measures of the underlying systematic risks that influence returns. This includes the possibility that some significant macroeconomic risk factors are omitted from the model because of lack of data. The second is that the lack of market efficiency may result in excess profits that can be gained by arbitrage, violating the major assumption of the exact formulation of the multifactor model. Finally, large idiosyncratic risks that are not fully diversified away may be present in investor portfolios. These do not necessarily invalidate the model but they can lead to large pricing errors such that tests have little power to reject the null hypothesis that factor prices are zero. Thus, systematic risks due to macroeconomic factors, while significant, may not by themselves be able to fully explain observed variation in stock returns. Some areas for further research are indicated.