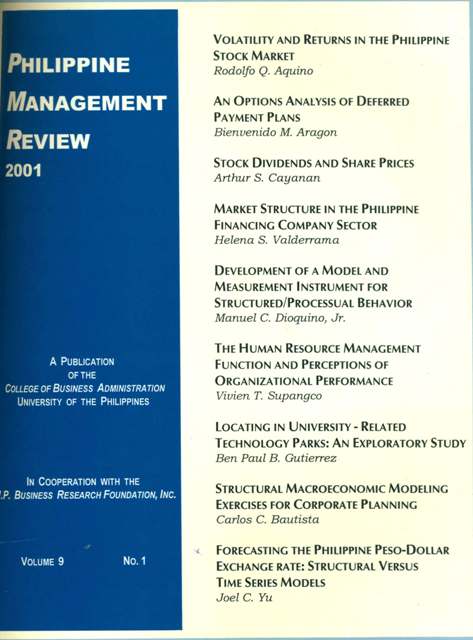

Stock Dividends and Share Prices

Abstract

Given the information asymmetry between the management of a company and its stockholders, it has been argued that stock dividend declarations have information content, even if such declarations are not accompanied by any distribution of the company’s cash resources. A general explanation for this is premised on the hypothesis that stock dividend declarations signal the earnings potential of a firm. This study investigates the effects of stock dividend declarations on share prices on and around the announcement dates using Philippine data. Applying the “market adjusted returns” model, the findings show that no abnormal returns are observed on and around the announcement dates. This implies that stock dividend declarations do not convey any information about the earnings of a firm.