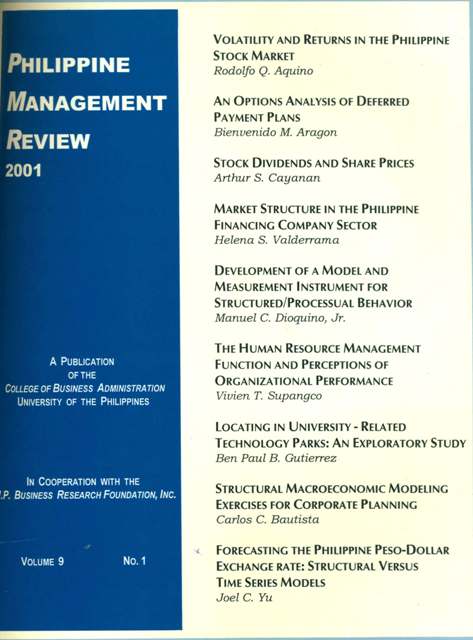

Structural Macroeconomic Modeling Exercises for Corporate Planning

Abstract

This paper presents a simple, easy-to-use structural macroeconometric model designed to generate quarterly forecasts of four key macroeconomic variables – the exchange rate, the interest rate, the inflation rate, and the GDP growth rate. The model’s appeal is the ease by which timely forecasts, based on sound economic principles, can be made. This is important from a corporate planner’s perspective especially when macroeconomic events heavily influence the direction of a firm’s growth. The model is estimated by ordinary least squares using quarterly Philippine data from 1981:1 to 2000:3. Historical simulations, both static and dynamic, were conducted to gauge the tracking ability of the model.

The first sample application makes a forecast of the four variables for the year 2001 based on the recently concluded EDSA II and assumptions on other exogenous variables: liquidity follows its trend growth; CPSD/GDP = -4 percent and CA/GDP = 9 percent. The unprecedented discrete movement of the exchange rate from 54.7 to 47.5 pesos per dollar shifts the end-of-year forecast of 2.3 percent GDP growth to 3.1 percent. The second example computes for the 2001 growth rate that is compatible with a government deficit of 225 billion pesos. Growth with this deficit level turns out to be 2.7 percent. Monte Carlo simulations were conducted so that forecast confidence intervals can be obtained.