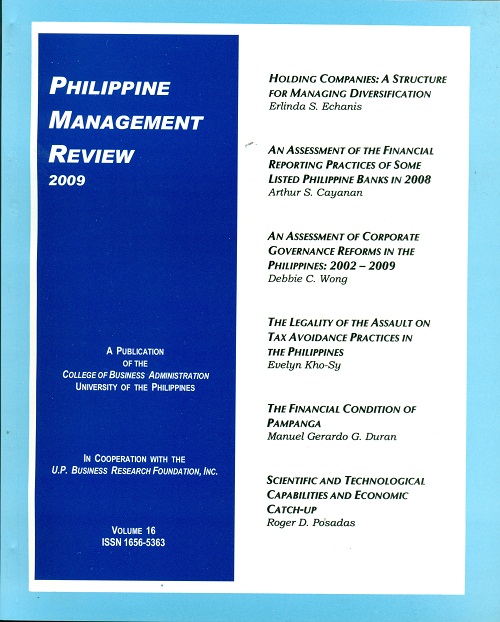

AN ASSESSMENT OF CORPORATE GOVERNANCE REFORMS IN THE PHILIPPINES: 2002 – 2009

Abstract

This paper intends to present an update of the various corporate governance reforms in the Philippines since the adoption of the 2002 Code of Corporate Governance issued by the Philippine Securities and Exchange Commission(SEC). A comparison of these reforms against the Sarbanes-Oxley Act in the United States is also shown. The paper ends by discussing the various assessments conducted by various local and international organizations and how these corporate governance reforms in the Philippines compare with thosein our Asian neighbors.Corporate governance has been a global buzzword in the public and private sectors for more than a decade now. Renewed interest on corporate governance was in full swing especially after the 1997-98 Asian financial crisis and after aspate of international corporate failures and scandals in the early 2000 that rocked some of the more developed and solid economies in the world. Leading the corporate scandals is the high-profile Enron fiasco that robbed many of their investment and retirement money. Against this dwindling public confidence backdrop, corporate governance initiatives and reforms, which aim to restore market integrity and to regain lost trust of investors, were rekindled all around the world. The Philippines, specifically its various regulatory bodies, has implemented many of the reforms recommended by the Organization for Economic Cooperation and Development (OECD), the World Bank (WB), the International Finance Corporation (IFC), the Asian Development Bank (ADB), the Center for International Private Enterprises (CIPE), the International Corporate Governance Network and the Asian Corporate Governance Association to mention a few.

Published

2010-07-05

How to Cite

WONG, Debbie C..

AN ASSESSMENT OF CORPORATE GOVERNANCE REFORMS IN THE PHILIPPINES: 2002 – 2009.

Philippine Management Review, [S.l.], v. 16, july 2010.

Available at: <https://journals.upd.edu.ph/index.php/pmr/article/view/1796>. Date accessed: 02 sep. 2025.

Issue

Section

Articles

Keywords

Corporate governance, agency problem, separation of ownership and control, OECD Principles