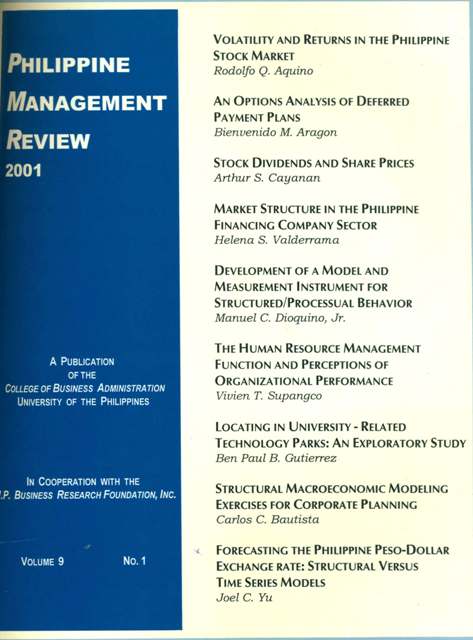

An Options Analysis of Deferred Payment Plans

Abstract

Deferred payment plans (DPPs) are quite common for high value items such as real property, cars, etc. Discounted cash flow (DCF) analysis has been the traditional technique for analysing DPPs. This usually involves computing the effective interest rate implicit in the arrangement. This approach ignores the real options embedded in the arrangement. An options analysis of DPPs may yield useful insights that may not be evident in DCF analysis. As the paper will show, a DPP is equivalent to a call option with an extendible life and a declining exercise price. This approach is particularly useful when the DPP is being used to acquire an asset for investment or speculative purposes. The binomial option pricing model (BOPM) will be used to value the options in simple DPPs and to analyze how the option value reacts to changes in several variables. Overall, the results are consistent with option pricing theory.