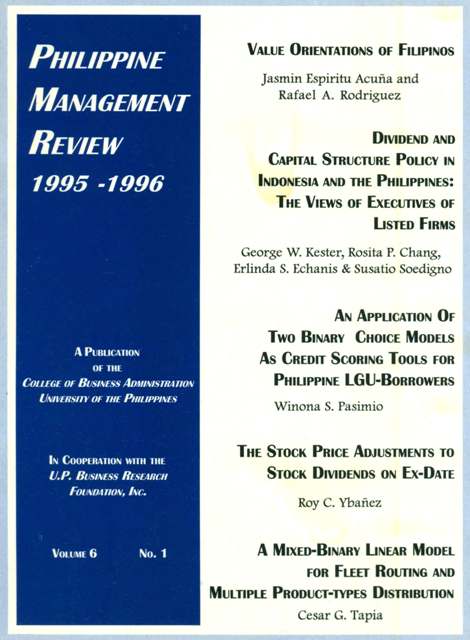

The Stock Price Adjustments to Stock Dividends on Ex-Date

Abstract

This paper provides empirical evidence of expected price adjustments on and around the ex-date of stock dividends. Since the ex-date normally occurs weeks after the announcement date, ex-date price adjustments in an efficient market should be wealth-preserving, i.e., stock prices decline in proportion to the higher number of shares corresponding to the stock dividend. Price adjustments that result in abnormal returns are generally attributed to some form of market friction or inefficiency. The possible factors in the Philippine case are odd lot costs, the trading rule that limits price movements to discrete increments, the illiquidity due to delayed issuance of the corresponding shares, and transactional costs. The study finds that other than a reasonable allowance for transactions costs, there is no unusual price pattern on the ex-date of stock dividends, and for the period immediately surrounding the ex-date. This is generally consistent with efficient market expectations. These findings are based on a market-adjusted-return model applied to a sample of 58 stock dividend declarations in 1995-1996 involving 44 different companies.