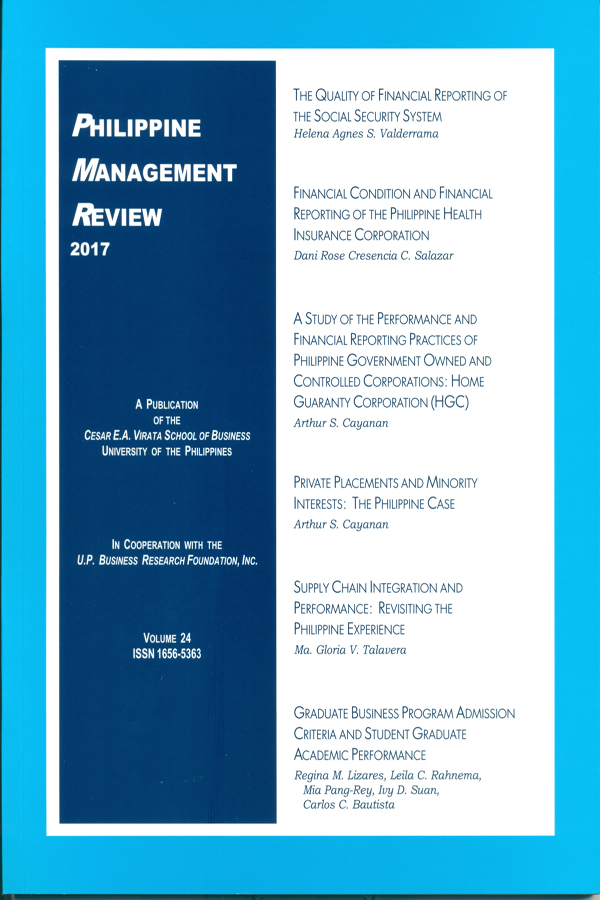

The Quality of Financial Reporting of the Social Security System

Abstract

This study analyzed the financial reporting practices of the biggest pension fund covering employees of the private sector in the Philippines – the Social Security System (SSS). Of particular interest in the present assessment of the SSS financial reports was the sufficiency and quality of information available in the reports for users to assess the System’s financial position, performance, and cash flows. The study finds that, despite the unqualified opinion given the reports by the Commission on Audit, there are inadequacies in the reporting practices of the SSS regarding receivables, investment property, and its pension and insurance liabilities. Thus, there is insufficient quality information provided in the SSS’ financial reports to enable users to assess its financial condition, including its disclosed unfunded liability of ₱1.22 trillion as of 2011. The study also presents findings comparing the performance of the SSS with the GSIS and with two government pension funds in Thailand and Singapore. It concludes with a number of policy issues relating to the pension fund system of the Philippines

Published

2017-08-22

How to Cite

VALDERRAMA, Helena Agnes S..

The Quality of Financial Reporting of the Social Security System.

Philippine Management Review, [S.l.], v. 24, aug. 2017.

Available at: <https://journals.upd.edu.ph/index.php/pmr/article/view/5718>. Date accessed: 30 aug. 2025.

Issue

Section

Articles